Deterra Royalties ($DRR.AX): A Very "Australian" Story

A great asset tarnished by "Australian" capital allocation

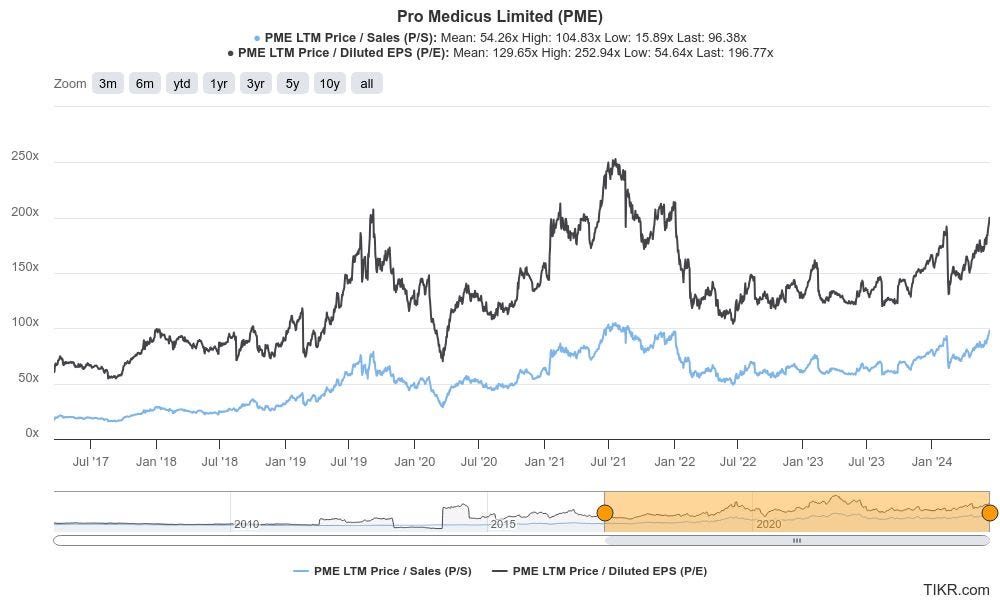

I am asked frequently why I don’t really invest in Australian equities. It’s not a particularly easy question to answer. I find the local market a little parochial, with a dearth of very high quality businesses that I am able to understand. Due to Australia having one of the world's largest forced savings schemes, referred to as Superannuation (‘Super’ for short), anything that even remotely whiffs of quality gets bid to levels that are ridiculous by any conceivable metric. Behold:

While I don't want to underplay the entrepreneurial achievement behind PME 0.00%↑ I do want to note how absurd its current and historical valuation has been, despite massive share price outperformance.

Management’s vary all the way from the hairbrained entrepreneurial founder to the very suspect promoter type, and everything in between. In any event, Australia, like many peripheral Western markets, experiences what is called the quality blackhole. The truly successful international franchises typically list on the leading American exchanges, leaving an eclectic collection of businesses for domestic investors to pick from. Certain tax arrangements massively incentivise dividends over reinvestment, and regular share repurchases are hard to come by (although you might be surprised to learn that PME is doing one!).

The Australian small cap universe is especially well picked over, and being successful in that domain usually means identifying successful entrepreneurs ex-ante. This is a discipline that has been well practiced by many an individual investor. However, it’s just not my game. On the other hand, from time to time, an asset becomes available on the Australian Stock Exchange (ASX) that even someone with my limitations can understand.

Set quite aside from the wider Australian retail investing community, is a kind of gambler(?) that specialises in speculative mineral discovery. Australia is something of a Mecca for these kind of operations, and everyone knows someone who has an inside line into the next great mineral deposit. The hallowed forums of HotCopper are replete with these kinds of promotions/half-truths/scams. Between this end of the market, and the reputable large mining operations, emerged an iron ore royalty that exists largely due to a kind of historical mistake (feel the hairs on the back of your neck rising?): Deterra Royalties.

The story encapsulates many of my frustrations with Australian corporate culture.

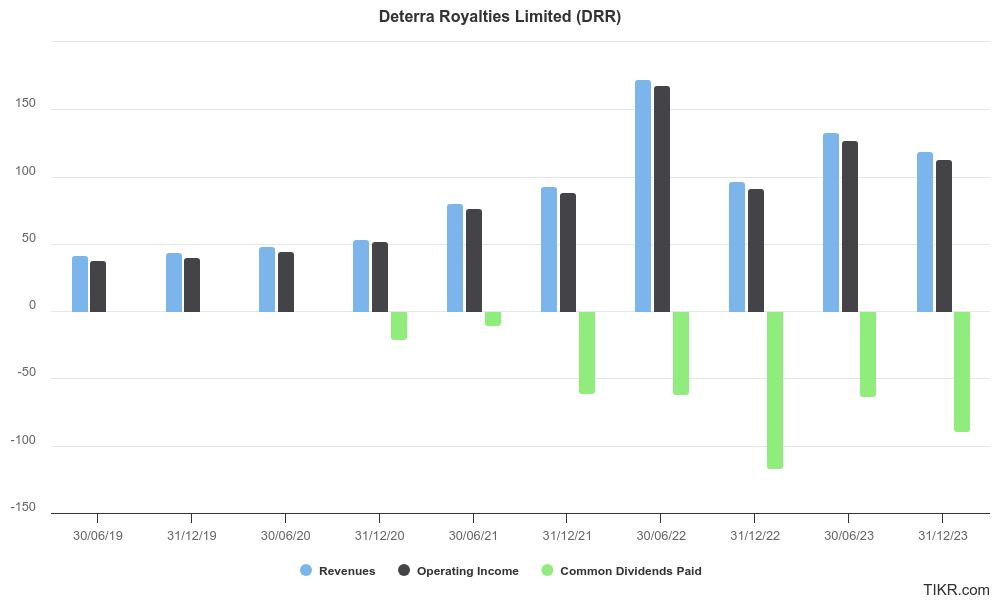

Putting aside the quality of the asset in question (we’ll get to this shortly), the name has become something of a meme on Australian Fintwit due to its laughable cost structure:

As of this writing the company has 9 full time staff members. Until quite recently, the only operational needs of the firm were limited to getting the royalty payments safely delivered to the corporate account. We’ll get to renumeration further on, be prepared to be tickled silly.

History

Luckily, we have the great Andrew Brown to thank for a pretty handy summary of the historical context:

Before 2020, the royalty was owned by the aforementioned Iluka Resources. Their business is in mineral sands exploration. In late October 2020, Iluka demerged from Deterra and the two became separate entities under the following structure and understanding:

I believe the kids call the highlighted part a red flag.

General Business & Assets

At the time of the Demerger, Deterra primarily owned a 1.232% revenue royalty on Mining Area C (MAC) in the Pilbara, Western Australia:

Mining Area C is located approximately 90km north west of Newman Township in the Pilbara region of Western Australia, one of the premier iron ore provinces in the world.

Operated by BHP, Mining Area C will form the largest operating iron ore hub in the world, producing 145 million tonnes of iron ore each year when the recently completed South Flank expansion reaches full production.

Deterra’s royalty agreement with BHP and its partners Itochu and Mitsui (the “MAC”) provides for a revenue-based royalty and production capacity payments consisting of:

ongoing quarterly royalty payments of 1.232 per cent of Australian denominated revenue from the MAC Royalty Area; and

a series of one-off payments of AUD$1 million per million dry tonne increase in the annual production level from the MAC Royalty Area during any 12 month period ending 30 June above the previous highest annual production level.

From my best sleuthing, MAC has a production half-life of about 30 years, with some planning in the works to extend operations well beyond that. One also doesn’t need to have any anxieties about the royalty’s counterparty - BHP is of course one of the world’s best run mining companies, dominating the iron ore trade in Australia. A question I had about the site is: why would BHP choose to continue mining MAC when they are paying a pretty penny off the top line? The answer is to be found in the fact that the operation is very efficient and low cost due to the pure scale mentioned above. It certainly makes sense to exploit it.

I write a lot about royalty-like businesses that can grow without needing additional capital investment. This was, and for now mostly still is, a literal royalty stream with visible underlying production expansion (read volume growth), and production level kickers. You won’t find many assets like it.

The inputs to the royalty revenue are fairly straightforward. Firstly there is the volume of iron ore sold. Secondly, there is the price at which the iron ore is sold. Finally, there is the exchange rate of AUD/USD. This particular royalty offers negative exposure to AUD while still being an AUD denominated asset (a state of affairs I do not mind).

In the years before the Demerger volumes grew nicely:

However, the long term annual volume capacity of MAC is much higher:

Iron ore pricing is an uncontrollable variable, as is the conversion rate between Australian and United States Dollars. However, multiplicative volume expansion can make up for a lot of volatility in those inputs, both of which have both been supportive in the intervening years.

As far as quality assets goes, this is still one of the better ones that is publicly available in Australia.

Management & “Strategy”

What put me off Deterra originally, and what I still get a laugh out of today, is management’s stated strategy of ‘acquisition of value accretive complementary royalties’. This strategy presupposes a couple of things. Firstly, that they are actually able to find attractively priced royalties for sale. This is a task made all the more difficult by the fact that there are far more experienced, and much more advantageously funded players out there. Who’s going to be the patsy at that particular poker table?

The more cynical take on management’s strategy is simply that is has been a smoke screen for outrageous compensation and business development expenses. For the Financial Year 2021, CEO Julian Andrews and CFO (now Head of Corporate Development) Brendan Ryan received a combined $1M+ in compensation. One ponders the question: for what!?

I reiterate that until quite recently Deterra’s only function was in the collection of royalty payments and the dispersal of them to shareholders in the form of dividends.

Speed the clock forward to 2023 and Andrews and Ryan’s combined statutory compensation eclipsed $2.5M! A tidy sum for the passive collection of $240M in operating income. Deterra now has annual expenses totalling more than $11M and, as I mentioned before, a full time staff of 9! In this writer’s humble opinion, Deterra needs exactly 1 line of code to operate effectively.

Over 3.5 years have passed since the Demerger and with many millions of dollars spent on salaries, bonuses, and business development, Deterra has finally identified an acquisition target. The staff of 9 have produced something, I guess.

The real issue at play here is that management is taking the proceeds of an excellent asset (as far as mining royalties go) and redeploying them into almost certainly lower grade assets. We’ve all seen this movie before:

The Deal

As per Deterra’s latest announcement:

Deterra Royalties Limited (Deterra) announce an all-cash offer to acquire the entire issued and to be issued share capital of Trident Royalties plc (Trident) for 49p per Trident share, for total cash consideration of approximately £144 million (A$276 million)

Trident is a diversified mining royalty company based in the UK and listed on the AIM Market of the London Stock Exchange, with a portfolio of 21 royalties and royalty-like offtake contracts providing exposure to base, precious, bulk and battery metals, including lithium, gold, silver, copper, zinc, mineral sands and iron ore

The Transaction will be implemented by way of a UK scheme of arrangement (Scheme) and is subject to Trident shareholder and Court approvals and other conditions precedent that are customary for a UK scheme

The Board of Trident intends to unanimously recommend that all Trident shareholders vote in favour of the Scheme (defined below) and each Trident Director has given an irrevocable undertaking to vote in favour of the Scheme in respect of their interests

In aggregate, Deterra has received irrevocable undertakings and a letter of intent to vote in favour of the Scheme from the holders of approximately 84.1 million Trident shares in total representing approximately 28.7 per cent of Trident’s issued share capital

The Scheme is targeted for implementation in H2 2024

Andrews made the following remark in the announcement:

“In particular, the Trident portfolio offers significant exposure to battery metals, including a high quality ‘marquee’ asset in the form of its royalty over Lithium Americas Corporation’s Thacker Pass operation. This is a large-scale, long-life, development-stage lithium project which is currently finalising corporate funding requirements which, alongside DoE project financing, will ensure Thacker Pass is fully funded. Trident’s remaining assets would provide both immediate cash flows to Deterra and a range of growth options.”

A few things should be noted. Deterra’s MAC royalty is not even remotely comparable to the arrangement of assets they are buying here. Only 13 of Trident’s 21 royalties are producing cash. There are a collection of production ‘offtake’ deals, as well as varying terms for some of the currently extant development royalties. Certainly the counterparties faced by the Trident assets are not BHP.

As Deterra will be assuming Trident’s debt, the deal has an EV of well over 300M AUD, with last year’s revenues totalling 14.3M AUD. Trident has largely funded itself with debt and equity having never returned any real money to shareholders. Colour me a tad sceptical.

As Deterra is publicly traded its opportunity cost of capital needs to encapsulate its own shares. It has very little debt, strong secular growth vectors, and trades at probably a mid to high teens normalised multiple of earnings, while being able return 100% of its proceeds in cash. Contrast this against the hodgepodge of assets on the table with Trident and it’s not hard to see how management’s dreams of corporate glory are obscuring their judgement - although they are literally getting paid to do exactly that.

Management will be hosting a call tomorrow to walk through the deal. I’ll be watching from the cheap seats.

Larry.

Very good. I tried to like Trident, as it's an easy investment on my home turf, but just didn't feel right.

As a 'Royalty' fan, I looked at Deterra a year or two ago, but couldn't get a handle on it. Frustratingly, management are almost always a problem at Mineral Royalty businesses around the world - I suppose it's irresistible if they can get a seat at the table.

Dorchester Minerals (Oily) are one of the few that seem decent, but it's v tax-inefficient for us Non-US investors, for both Income and Capital Gains (you probabably know all this). Texas Pacific has been insane, but is still performing OK. Prairie Sky are another that seem to have a decent management. I haven't looked at the smaller Trusts because of tax issues.

Gold - the two decent ones seem too big now, and the rest I can't get a handle on, though I know some like Sandstorm & Osisko - haven't seen it myself yet.

Altius is a more grown-up Trident, & some respect the management, but I'm still suspicious, and the performance is nothing to write home about.

Good stuff mate.