*In the interests of brevity quite a bit of the minutiae has been paraphrased or lightly mentioned. As always do you your own homework.

I have resisted the urge to write about Dye and Durham ($DND.TO) for quite some time. Primarily this is has been because the story has been so dynamic and fluid - even a short article would require several updates in short order. In any case, events are coming to ahead, and developments are beginning to overtake us all - management included.

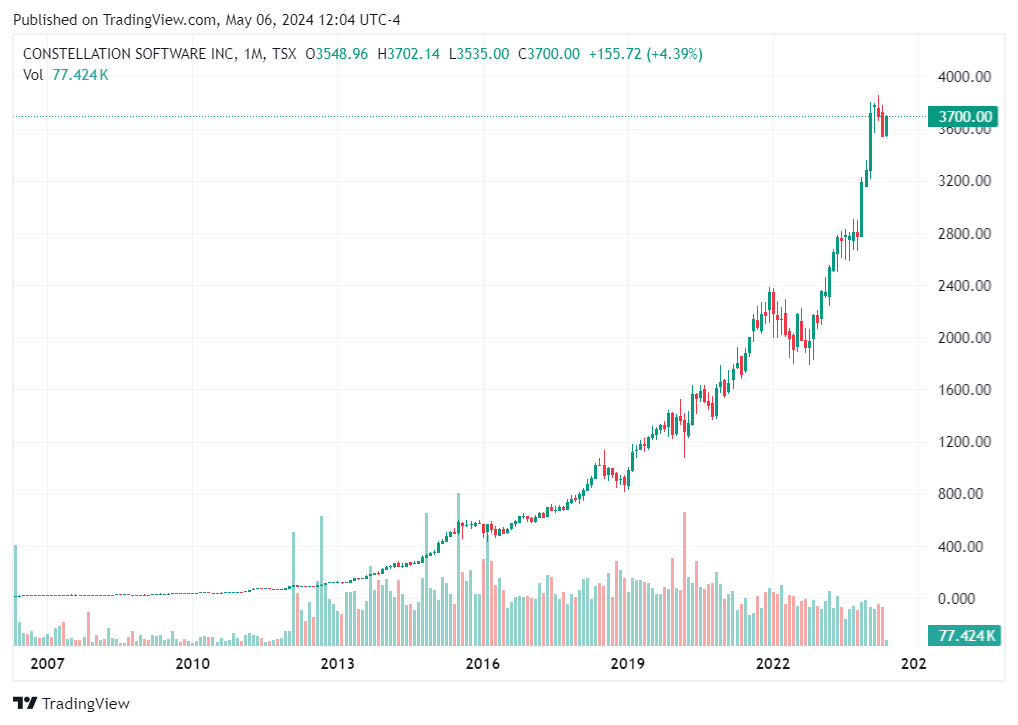

I am not partial to roll ups. I can, however, see their allure. For the spreadsheet crowd, industry consolidation plays are intoxicating. Even more exciting is the fact that some of them actually work. And work spectacularly - we’re all familiar with:

Plenty of them also don’t work. Even worse, some of them work for a while, and then spectacularly stop working. While I don’t quarrel with the fact that rational capital allocation executed against a focussed strategy can and does work (that’s certainly what I’m trying to do), what I find difficult is identifying the successes ex-ante. I also find it remarkably difficult to identify moments in time when a hitherto successful management team veers into mismanagement, folly, and sometimes even accounting fraud (see the Valeant saga). Many other highly respected value investors have had the same difficulty.

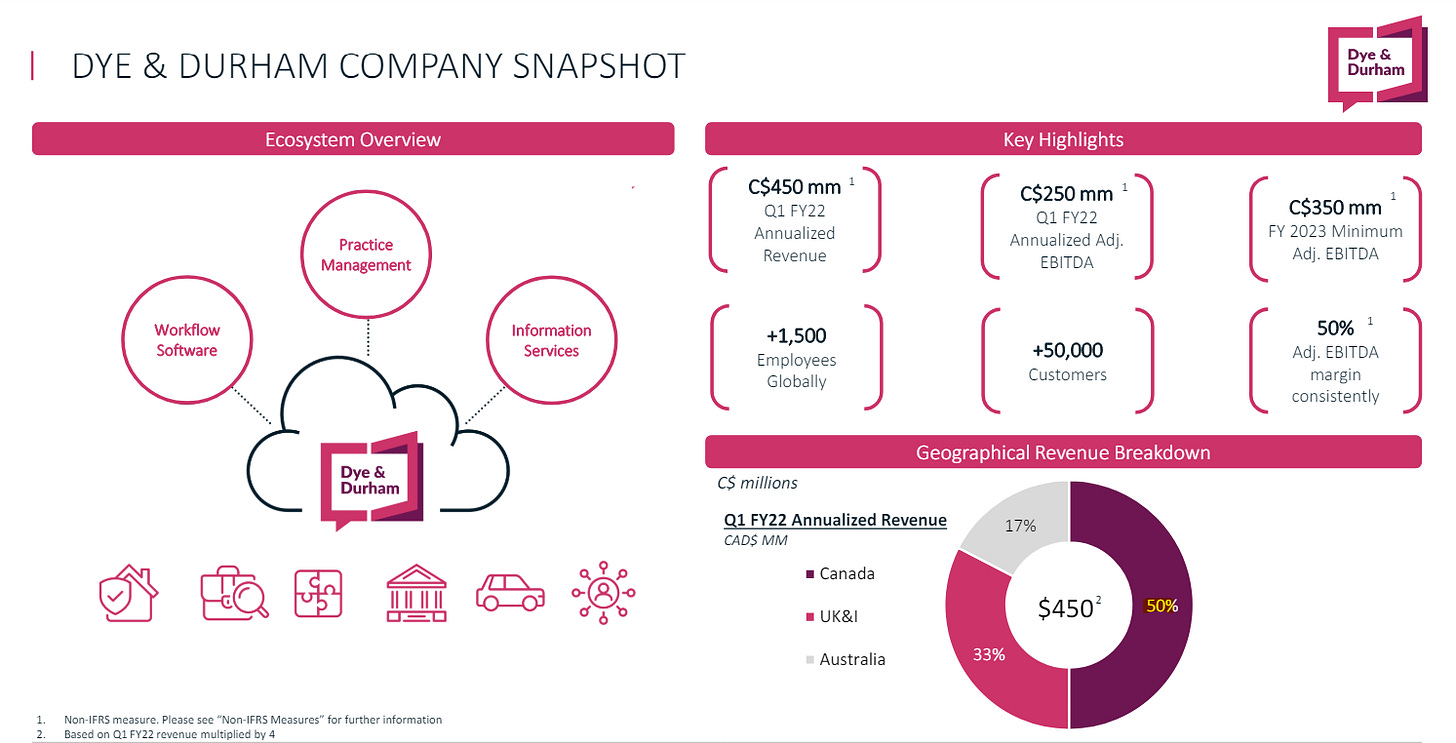

DND is somehow a success story and a cautionary tale at the same time. Broadly speaking, they are a collection of first rate assets wrapped up in a devilish capital structure, accompanied by some very ‘unconventional’ capital allocation. While anyone who is even remotely familiar with the name would be aware of the tremendous pricing power they have exercised across the registry and real estate transaction-related businesses, much of the company’s conduct otherwise has left something to be desired.

DND is a storied name that has served clients with office stationary, amongst other legal related services, for over 140 years. In 2016 it was acquired by OneMove Technologies, which itself provides conveyancing software econveyance in Western Canada. Enter current DND CEO, then OneMove CEO Matthew Proud. Proud’s personal history is interesting. A Canadian native, he completed a BA and Law degree at Cambridge University before returning to North America. Putting aside some of the conjecture about the irregularities in his personal story (who am I to question unconventional backgrounds?), Proud’s Bermuda-based investment company Plantro bid for control of OneMove in 2012, becoming CEO in 2014.

If you’re getting a little confused, unfortunately it’s going to get worse. This pattern of complex and opaque ownership structures, engendered by a never ending list of transactions, is a staple of the Proud regime. From what I can piece together, the original strategy communicated by Proud, and his brother Tyler, is fairly straightforward. Within the legal profession, especially in the United Kingdom and it’s once self-governing dependencies (Canada and Australia), there are a myriad of software programs that service certain process steps. OneMove’s key product automated the transfer of property titles (i.e. conveyancing). This kind of product is a natural monopoly - it’s more efficient for a single, or small number of interoperable, providers to facilitate transactions. The classic network effect.

Naturally, some of the legacy products serving these processes preceded the move to browser-based and cloud-based software. This kind of balkanisation of different discreet programs historically led to an unconsolidated market structure. Hence the Proud’s, and now DND’s, vision of rolling up as many of these different products into one easily accessible platform. Due to the naturally good economics of software coupled with a quasi-government sanction (the process steps for property transfer are heavily regulated and a source of revenue for the state), this has been a pretty fruitful place to build a business. Unfortunately, it has also required would-be consolidators to pay very fancy prices for acquisitions. More on all of this later.

From the time Proud took the reigns at OneMove, and later DND, until the latter went public in July 2020, he completed (by my count) 11 acquisitions. The company’s first quarter as a publicly listed firm saw them make $21.9M CAD in revenues and $12.5M in adjusted EBITDA. I’ll add a little more colour on the focus of these two items later, but suffice to say they have not necessarily been value accretive. As Proud would say in a December 2020 roundtable, the purpose for listing publicly was to allow for greater balance sheet flexibility and liquidity for existing investors. For a company executing a prodigious number of acquisitions, the capital allocation flexibility is certainly a positive - to date DND has raised and paid down various forms of debt, repurchased and issue shares outstanding, bought and sold businesses. Pulling the trigger on nearly every conceivable capital allocation decision aside (thank god they have been allergic to growth capex), once DND became a publicly traded company it was demonstrably able to decrease its cost of, and access to, capital:

We also entered into a new credit facility for $140 million revolving term loan facility with an additional uncommitted accordion of up to $25 million. This gives us an aggregate total of $165 million of credit capacity. The interest rate under our new credit facility is expected to be approximately 3% versus our old prior credit facility, which carried an interest rate of 8.5%. We believe this lower interest rate is expected to significantly improve the company's levered free cash flow. Also, on September 30, we closed a $50 million bought deal private placement.

Matthew Proud, Q1 2021 Earnings Call

As to whether the legitimacy of being a public company, and the associated access to capital that came with it, was a positive thing (on balance anyway) is open to some interpretation. At this stage it’s probably worth covering the broader strategy at play here.

Early in DND’s life as a public company Proud announced the goal of “Build to a Billion”. As per the Australian Financial Review:

He is incredibly ambitious and has set out a broad corporate strategy for Dye & Durham with a catchcry of “build to a billion” – as in a billion dollars in profit. He hasn’t put a timeframe on when he aims to reach it. “We’d like to get there sooner rather than later,” he said.

Not to split hairs with the AFR, but what Proud really meant was a billion dollars in EBITDA, and adjusted EBITDA for that matter. Charlie Munger once quipped that when you hear the word EBITDA - think bullshit earnings. It’s also important to remember that the metric was popularised by John Malone within the context of rolling up local cable monopolies. How that reconciles with a software roll up is a little beyond me, but I’ll digress. The focus on a metric which is so easily manipulated - and in this case constantly adjusted by the company - leads to all kinds of maligned outcomes. The secondary metric pursued historically by DND is revenue growth. In any event, I’d content that neither metric relates to value in any way, shape, or form. While I have explained parts of the wider strategy which I’ll openly admit are cogent (i.e. getting control of automated mandated process steps and mission critical software with untapped pricing power), where this has veered off is simply that DND has ended up paying extraordinarily high prices for most of their acquisitions.

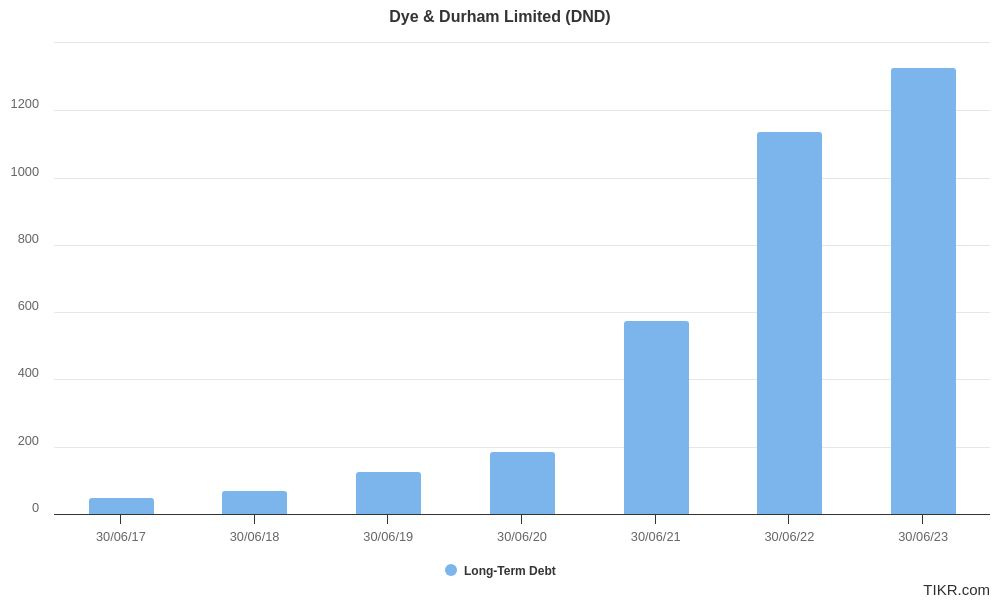

While many of us can certainly relate to overpaying for stocks, the problem that happens when you are buying private businesses at stretched prices (irrespective of their quality), on a levered balance, is that you inevitably run into mismatched cashflows and financing costs. The music might stop, but your liabilities don’t. This is where an overview of the historic business lines will be helpful.

When DND became a public company, and for at least a couple of years after, most of their business was transactional, and based in Canada. Although it’s worth noting that similar dynamics were at play in Australia, the United Kingdom & Ireland, they faced significantly more competition in these markets.

While not broken out above, a great deal of this revenue was derived from real estate transactions. It won’t be a surprise to anyone that because of this the business was, and still is, heavily tied to the interest rate cycle. Naturally as interest rates increase property transaction volumes go down. At some extreme enough level volumes pick up again as forced selling hits the market. On the unit level, most of DND’s products in Canada are priced in multi-year (typically 3 year) deals. The nature of the Workflow and Practice Management products (which are now converging into a single platform) is that it’s not a ‘nice to have’ as much as it is critical to the proper functioning of a modern legal practice. There are also very few providers (Canadian courts have upheld industry consolidation), and by what I’ve been told it’s very painful to switch, especially in Practice Management.

It has not been uncommon for DND clients in Canada to report significant price increases upon contract renewal in the last two years. This was accompanied by an enormous price increases in one of DND’s business registry’s in Canada.

The strategy around price taking, in my opinion, has likewise been haphazard. As far as I can tell price has been taken reactively to the needs of the business elsewhere - usually, and most pressingly, the balance sheet. Certainly a clearly communicated part of the strategy has been synergies. The ability for DND to bring products, and their customers, onto their platform has allowed for them to reduce some duplicate roles across equivalent products. However, the fact that the company has now been on a tear with respect to reducing head count vindicates my original take the company has been focussed on deal making first, and efficiency only to the extent that it will allow them to make more deals. Again, this is not a traditional path to value creation.

With the dynamics of the business in mind, it’s clear to see how the company is exposed to interest rates in several forms: business-level and balance sheet level. When volumes in real estate transactions fell precipitously in 2022, and interest rates rose, it left the business in a tough spot. This was also roughly around the time that the company’s bid for Link Group - an Australian company that offers a range of data and technology solution across several end markets, that also held a significant stake in PEXA Group (the country’s online settlement monopoly) - fell through. Putting aside the strategic initiative here (which had the nimbus of brilliance), DND ran a significant debt load into a maelstrom of higher rates and declining volumes in real estate transactions:

I am still an awe of Proud’s ability to parlay the company’s prior success in M&A into almost 2 billion dollars in credit facilities and long term debt. In early October 2021, DND announced the following:

Keep reading with a 7-day free trial

Subscribe to Buyback Capital to keep reading this post and get 7 days of free access to the full post archives.