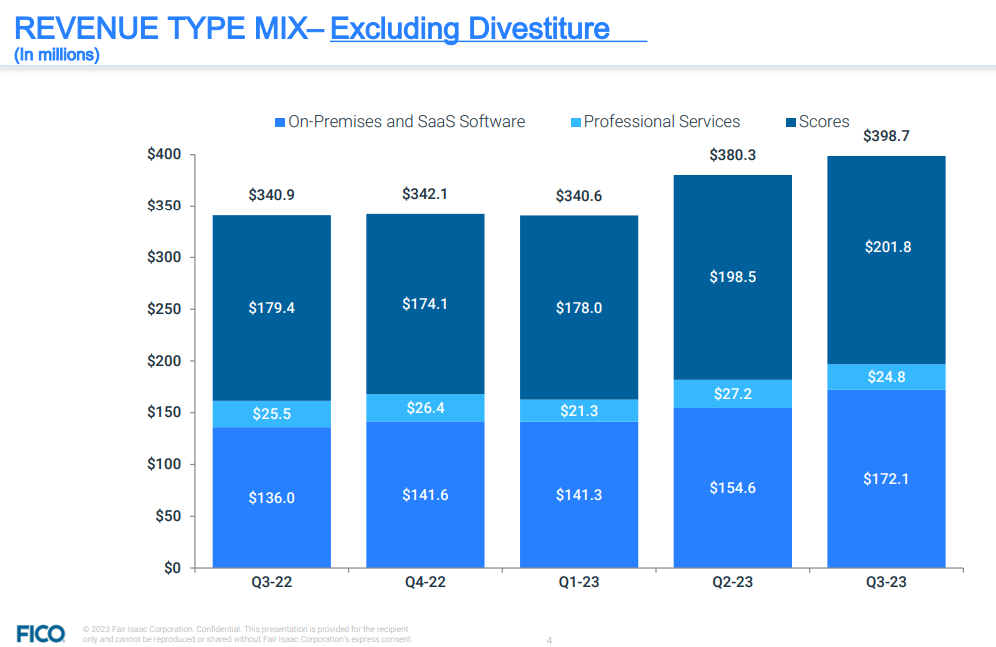

FICO reported 3rd Quarter earning on June 30th. The company once again reported outstanding results, driven in part by steady progress in Scores, and a larger than expected bump in Software revenues. Aside from the excellent - albeit somewhat predictable - results there were a number of developments in Mortgage that will have interesting implications for the company going forward.

Scores

Scores revenues came in at $201.8M for Q3 2023. This was an outstanding 13% growth YoY. It was also a bump of 2% QoQ. B2B Scores posted an impressive 24% growth YoY with B2C showing a predictable decline of 11%. The most… ah stunning… growth vector in B2B was Mortgage at growth 135% vs. Q3 22. As many have been speculating, normalisation in Mortgage originations will be a significant tailwind for the company for quite some time. CY 22 was a year of very precipitous declines in originations due to the stunning rise in interest rates coming out of the Pandemic. FICO enacted price rises in this part of the Scores business which not even the most swashbuckling capitalists amongst us could have envisioned:

The setup is significant going forward - where volumes begin to grow in line with these… ahh “substantial” price hikes, we should see very significant financial performance out of Scores. Mortgage is of course one of the FICO Score’s most important end markets as it enjoys a regulatory monopoly.

This is record revenue performance from Scores, which naturally bodes well for FICO’s bottom line - all Scores revenue is incremental to margins and free cash flow. Low teens revenue growth here translates into quite a bit more than that in EPS growth.

Even more impressive is that volumes across the board are generally flat or down:

So I mean, they all had some pricing increases this year, probably more in line with CPI. In terms of volumes, mortgage is still down. We're seeing the same decreases that the bureaus are reporting. Auto was relatively flat year-over-year. And card's actually down a little bit. The originations this quarter are actually down a little bit. So we don't go into a lot more detail now, but you can kind of back into what -- we see the same things that the bureaus see in terms of volumes.

Chief Financial Officer, Steve Weber

Pricing is doing a tremendous amount of the lifting and this money machine continues it’s steady progress unabated.

Apart from the marvellous financial performance of this reporting segment, there have been some interesting developments in the Mortgage industry’s attitudes toward the Federal Housing Finance Agency’s (FHFA) judgement on what constitutes a conforming Fannie and Freddie mortgage (that is to say those mortgages that would be eligible for a 30 year fixed financing term). A quick primer.

Before 2022, the FHFA had mandated what was referred to as a tri-merged credit report for conforming mortgages. This constituted a borrower getting a credit report from each of the large 3 Credit Bureaus. Each of the credit reports were in turn mandated to ‘pull’ a FICO score. As you can see, a tidy little business for all involved (the borrower included if you don’t mind).

The Credit Bureaus were of course unhappy with this arrangement, to their great detriment. Forgive the quote: ‘Blessed are the meek, for they shall inherit the earth’. For a number of years they have been working to develop their own credit score, now known as Vantage Score. The intention was very clear - they were hoping to reduce costs for their customers (and potentially themselves) by replacing the FICO Score with their own. My sneaking suspicion is that they were also hoping to use their own score as a pretext to facilitate more lending, thus benefitting their own bottom lines. In any event, they lobbied the FHFA hard for a review of the existing system which was completed last year. That decision, which took 5 years to be passed down, delivered a new mandate for conforming mortgages known as bi-merge. Bi-merge now calls for only 2 credit reports, that will pull both a Vantage Score and a FICO Score.

Importantly, the FHFA gave the industry a short multi-year window to transition to the new model. On the surface, the ruling looks like slight negative for FICO, and looks like a definite self-own for the Credit Bureaus. The purpose of their ‘scheming’ was to cut out an independent provider of Scores. They have had their own included in the process, but they still need to have FICO Score for their credit report to be recognised. The need for only two credit reports also opens an interesting question: will the 3 Credit Bureaus now compete on the basis of price for customers? The regulator seems to think so:

“We believe after analysis that moving from three credit scores to two is going to be beneficial for the borrowers, and it will encourage competition from the credit reporting agencies,” Thompson said during the May hearing. “And it would lower costs for the borrowers because instead of three credit reports, they only pull two, and then the lender picks which two those are.”

FHFA Director Sandra Thompson

FICO on the other hand appears to have lost 1/3rd of their Mortgage Score volumes. This is true, but this decision has also been a catalyst for them to exercise the aggressive price hikes alluded to above. They are on track to simply eclipse the apparent volume hit with price. Impressive to say the least.

As per the FHFA’s determination, new conforming mortgages will need Vantage Score 4.0 and FICO 10. The current timeline seems impossible for many market participants to incorporate. Several consortiums have been pleading with the regulator for a slower approach to adopting the new guidelines. The general turmoil that this is causing has been exacerbated by FICO’s pricing policy:

“We are also concerned about expanding FICO’s role, considering the 400% credit report price increase FICO imposed last year,” the letter said. “In our November 30, 2022 letter to FHFA, we argued that Fannie and Freddie have the legal authority to establish conditions for such loans, asking FHFA to roll back the 400% price increase. CHLA also argued that arbitrarily exempting some 54 larger lenders from this price hike was discriminatory against smaller lenders, and that it violated at least the spirit of FHFA’s permanent policy of guarantee fee (G – Fee) parity.”

The government has taken no steps to regulate FICO’s unusual market position so far - but could.

For the time being Scores continues to be one of the great businesses at such large scale.

Software

Holy software revenues!

Anon Twitter user

Software Revenues also saw a significant bump, jumping to 16% YoY growth. Some portion of this was attributed to license renewals:

Manav, I will say that we did have some -- a fair amount of onetime license revenue this quarter that we probably may or may not have in the fourth quarter. So we don't want to count on that.

Chief Financial Officer, Steve Weber

The growth in Platform Annual Recurring Revenue (ARR), however, continues ahead at a breakneck pace growing in excess of 50% YoY. Non-platform ARR continues to grow at a very acceptable 11% YoY - however the purely SaaS Platform model is starting to make up a larger portion of annual ARR on the software side every quarter - it now constitutes 25% of overall ARR.

Software Operating Margins expanded to over 40% YoY for the quarter. Extremely impressive numbers, but somewhat unlikely to remain due to the unsual amount of one off business that occurred in the quarter.

If I’m being honest, the Software side of the business continues to be something a black-box to me - but I broadly know three things:

FICO’s software solutions help financial institutions save money on their lending decisions,

The payback period for the newer Platform solutions is less than 12 months, which is outstanding for any SaaS model,

Historically, transitions from Licenses to SaaS have been extremely value generative for shareholders across companies that have successfully bridged the gap. FICO has reported several years of 50% a year growth in this segment, as well as having shortened their pipeline lead times for these products. In short - they are in demand, and are finding ever greater use cases and adoption (not to mention operating leverage).

I continue to view Software as something of an option - and several friends have mentioned that at sufficient scale the Software segment of the business will be spun out into it’s own company. Interesting times ahead.

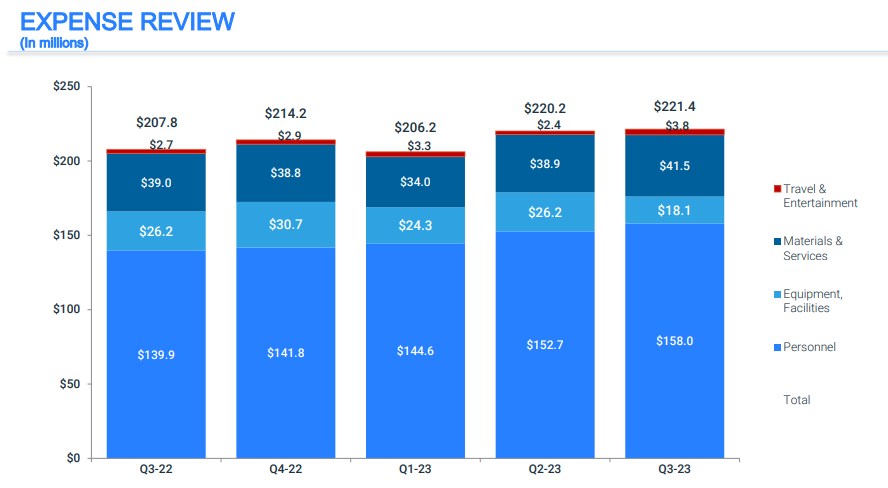

Financial Discipline

I am never not impressed by FICO’s ability to manage costs. The above chart speaks for itself, and speaks volumes. The company continues to execute strong financial performance well in excess of the costs it takes to generate that performance. As they have very little in the way of capital expenditures or R&D outlays, the company has essentially been able to generate an additional $58M worth of quarterly revenues for only $14M in expenses.

FICO’s total assets rose by 9% YoY for the quarter mainly due to a large bump in accounts receivables.

Overall Financials

Revenues, Gross Profit, Operating Income, and Margins hit historic highs for quarterly results.

Free cash flow was strong, and share repurchases were broadly in line with the company’s policy of returning all available cash flow to shareholders.

Not bad. Not bad at all.

Larry.

Winners keep winning.