Issue No. 25: Amazon Hitting Stride, Declining Franchises and How to Find Them

Outstanding Operating Results at Amazon, Lessons from Berkshire's 90' and 91' Annual Letters on the Decline of a Franchise Business

Amazon

Amazon reported Q2 earnings on August 3rd. This was an important quarter for several reasons, but mostly because it appears that the company has turned an important operating corner. Let me step back for a second.

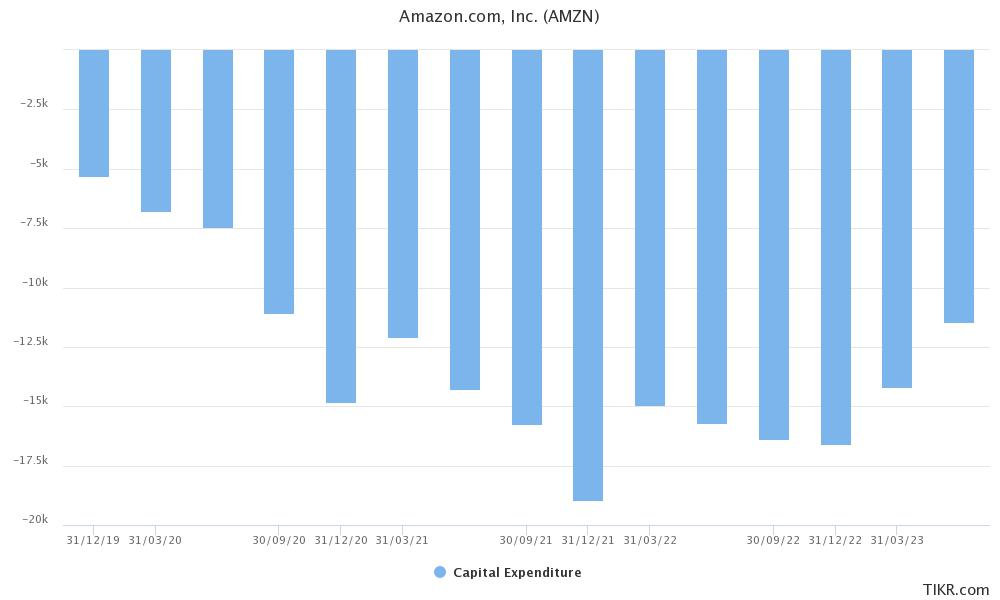

The post-Covid, and indeed post-Bezos period has been marked by several important themes playing out at Amazon. Firstly, Covid catalysed an enormous build-out of fulfilment, logistics, and cloud infrastructure. The unprecedented demand for, well, pretty much everything saw The Everything Store make unprecedented investments in both capital expenditures (more that $10B a quarter since 2020) and new staff (now well in excess of a million persons). A contentious question for the last several years has been: when will these expenditures normalise? It would appear that this particular investment cycle is ramping down:

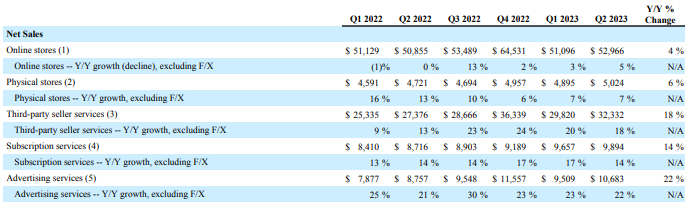

Secondly, Amazon’s traditional North American e-commerce business has been undergoing a sea-change in business quality. While the company was originally, and most famously, a retailer in it’s own right, it’s infrastructure is being utilised more and more by 3rd-party independent merchants. Access to Amazon’s infrastructure and demand aggregation is extremely valuable, with remarkable lock-in. Small businesses are price-takers, and once they are locked into Amazon’s various fulfilment, advertising, and merchant services they have very little choice but to dance whatever tune they are told. While sales in NA Online Stores continue growing at an anaemic pace, it’s what is happening between the margins that’s exciting. The rapid growth of high margin verticals in advertising, 3rd party merchant services, and subscriptions is pushing margins aggressively higher - and again this is set against slowing investments in the business. Amazon continues to scale out of a number of 1st-party SKUs - as the marketplace becomes ever more important the presence of obviously under-priced Amazon merchandise becomes morally challenging. It also draws the ire of the (completely ineffectual) regulators.

It only took me 20 months, and a 40% draw-down, but the inflection point I have been waiting for is finally upon us. Next quarter will very likely see the mix shift of retail revenue tip over 50% for the higher margin service line items seen above. Most impressive is the extraordinary growth in advertising revenue. This is also exciting when one considers the kind of margins this has garnered for the other large online advertising players.