All great investing track records are the result of leverage.

Fintwitisism

To get rich, you know, you’re going to need leverage.

Naval Ravikant

I’ll be resuming my adventures into thought leadership this week. A lot of what I am going to write about next has been inspired by foundational ideas from Peter Thiel, Warren Buffett, Naval Ravikant, and even some of my own experiences working in the world of the software and consumer internet. These ideas have percolated down into my choice of investments. I’m sure the patterns will not be ambiguous.

Leverage, or to give this idea another name - efficiency.

Probably the first thing that comes to mind when you think of ‘leverage’ is financial leverage. The predominant form of financial leverage is, of course, debt. There’s a time and a place for debt, but there are many other forms of leverage, and certainly other forms of financial leverage.

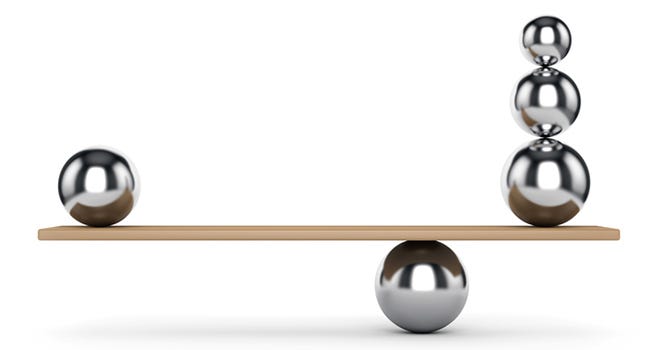

The more useful understanding of leverage in this context is the ability for a relatively small unit of input to create disproportionately larger output. In this way efficiency and leverage take on a similar meaning.

Naval categorises the main forms of leverage as:

Technology enabled leverage,

The ability to automate, and enable markets, and consequently to capture them in networks, at low to zero marginal cost of replication has created vast fortunes.

Media enabled leverage,

Starting with Gutenberg’s printing press, the ability to replicate ideas, music, writing, film, etc, and distribute it at low to zero marginal costs has also created many fortunes.

Financial leverage,

Financial leverage, either through borrowing money, managing other people’s money, insurance float, etc, has also been a consistent path to riches. For example, Buffett operates a collection of financial interests worth $868.29B with a staff of 25 people.

Labour leverage.

Often described as the oldest form of leverage. It is, however, the least efficient. Human beings aren’t easy to manage, and most investors and entrepreneurs are familiar with the agent-principal problem.

My favourite buybackism is to say that value is created between the margins. The proper application of leverage (or efficiency) is essentially the only way for a company to generate profits. Like Naval, I am mostly partial to technology and media leverage (this explains my love of Twitter), I am ambivalent to financial leverage (hostile to its worst forms), and uninterested in labour leverage.

Many forms of leverage masquerade, or are misunderstood to be, competitive advantages. Quite often competitive advantages are understood in terms of micro-economic phenomena that feed back on themselves. While I won’t reference the dreaded fly-wheel, we can think about this in terms of network effects (marginal users of a network adding value to them), and scale economies (efficiencies gained as additional scale is achieved). These are the ultimate forms of leverage. The same thing that engenders growth in either form also keeps it healthy (a rarity in nature). Ultimately, these are devilishly hard to establish, but once achieved their inertia is often enough to keep entropy at bay.

An ode to, and even an explanation of, leverage is the reality of our very unevenly distributed world. The Power Law:

“For whoever has will be given more, and they will have an abundance. Whoever does not have, even what they have will be taken from them” (Matthew 25:29). Albert Einstein made the same observation when he stated that compound interest was “the eighth wonder of the world,” “the greatest mathematical discovery of all time,” or even “the most powerful force in the universe.” Whichever version you prefer, you can’t miss his message: never underestimate exponential growth.

Peter Thiel, Zero to One

Many of these concepts are intertwined. The fact that the wealthiest 1% of individuals on the planet are worth more than the bottom 50% is much less a criticism of the elite’s rapacity, as it is an example of applied leverage in action.

The power law isn’t just a descriptor of outcomes in a general way, it also explains the outcomes of individual actions and decisions. One brilliant piece of software coded by a single engineer can have productivity outcomes that can dwarf the manual labour of millions of people. A few of you might be familiar with the epic story of Jeff Dean and Sanjay Ghemawat. In this case the work of two talented engineers delivered economic value worth more than what most of us could hope to achieve in several lifetimes.

At the business level, leverage is often underappreciated because of several inbuilt human biases. Firstly, there is an evolutionary (although also an economic) bias toward over-indexing on labour. Afterall, a professional manager will gain status (perhaps even recognition from their family) with more employees working under them. This status can translate into greater pay, and sway within the company. This is a nearly unavoidable state of affairs. Even now, most large corporates have been shedding employees after the excesses of the post-Pandemic rush for labour.

Secondly, the human brain is not well equipped to deal with exponential scenarios - it is built to deal with incremental ones. Several times in my career I have seen executives dismiss low input, high output opportunities. Often they are seen as quaint, or idiosyncratic, or (even worse) overly simple. In the technology world I have, conversely, seen executives fawn over agency-styled, and enterprise-level, labour intensive deals as opposed to developing recurring, low labour intensity businesses. People want to say they slayed a dragon; they don’t want to say they found a glitch that reproduces a roast chicken 10,000 times.

At the investment level, these business characteristics are obscured by the abstraction that is the stock market. Price, valuation, star signs, and various other arcane forms of sorcery used to predict stock movements are the most predictable ways that people forget that securities are just ownership stakes in businesses.

Often there is just a general underappreciation for what business actually is. My second favourite buybackism (perhaps I should start calling these laws…) is to put myself into the shoes of the day-to-day operational manager of a company I am thinking about investing in. Is this a job I would like to have? Is it straightforward? Could I mess it up easily? Is every day a living nightmare of seemingly impossible decisions to make?

I’ve worked in shitty, hard businesses, with countless legal potholes, and extremely stressed out CEOs who compulsively chain-smoked. I’ve also worked in businesses where the CEO could more often be found on the golf-course than the office. You probably wouldn’t be surprised which business made more money.

The general underappreciation of the importance of leverage is also related to a wider misunderstanding of what wealth is. Wealth is the money that comes to you without needing to do additional work. In the financial context, this is why so many investors migrate to long term quality investing over time. It’s a much more pleasant experience to get paid continually for one great decision, than it is to get paid for 50 (and with all the risks that come along with that). It’s often not a question of performance, it’s a question of leverage.

The best business to own during inflation is a tax on another person’s labour.

Warren Buffett

As is often the case, the old guy in Omaha got to many of these ideas decades before any of us. His purest expression of this was in his idea of what made a good business - Gross Revenue Royalties:

Benefiting directly from the large capital investments of the companies they serve, they require little working capital to operate, and, in fact, pour off cash to their owners. The unfortunate capital-intensive producer - Chrysler, Monsanto or International Harvester - can’t bring its wares to its customers’ notice without paying tribute to the “royalty” holder.

John Train, Warren Buffett: The investor’s investor

Buffett understood the importance of leveraging media, and controlling networks many years before Silicon Valley and the internet made it possible en masse.

He also understood the most efficient forms of financial leverage. The early Buffett Partnership was a pure leveraging of the accumulated capital of others, for which the he also got a healthy override. Only borrowing money rarely, he was quick to get his hands on the float of companies like National Indemnity, Blue Chip Stamps, and later GEICO after he took control of Berkshire. What differentiates insurance float from traditional debt is that it is remarkably low cost, and its largely non-callable. As Munger liked to say, you don’t need to be a genius to know that paying 2% for money and investing it at 12% is a good idea.

To give you a palpable example of the perfectly leveraged business, I present my precious Fair Isaac Corporation, and its Scores business. The FICO score is about as close to perfection as we’re ever going to get. It benefits from a standards moat, which resembles a network effect - in that once a standard is adopted is gains utility from each additional party to a transaction. It is the perfect beneficiary of zero marginal costs of replication, as the score is simply an algorithm that is licensed to various financial institutions. FICO doesn’t even need to run the compute to generate the score!

I have heard rumours, although this is not verified, that the scores business is administered by less that 100 full time employees. Last quarter it generated $192M in revenues at 88% operating margins. That is leverage.

The score is perfectly levered against inflation. It has annual CPI-linked pricing escalators, with additional, discretionary special pricing levers. It is also a beneficiary of financial leverage. Due to the extremely predicable nature of its business, FICO has been able to run a leverage share repurchase program that sees investors rewarded in excess of annual free cash flow generation. These borrowings are financed against the current business but they will be paid by FICO’s own inflated earnings in the future. This is a double boon to investors as modest stock prices amplify future returns.

*chef’s kiss*

In summary, leverage is critical concept. It is critical to your own personal success, and it is also critical to the success of your investments. Use it wisely.

Larry.