Some Updates

SHVA, GRND, Autocount

All of the above are held or have been.

I’ve been playing around with how to continue with the coverage updates. I think we might end up doing them as a data dump once a week or once every fortnight or something like that with a regular weekly article over the weekend. The feedback has generally been that they are desirable - I guess that is doubly the case when things go haywire, and that’s a probability in this game.

SHVA (Automatic Bank Services Limited)

Held.

After a very strong end to 2024, SHVA is now occupying a similar position in my mind as it did in the first quarter of last year: why does the stock keep going down, irrespective of its underlying business performance?

A few themes played out in tandem at the end of last year that catalysed significant share price gains. In no particular order these were: 1). optimism with respect to a second Trump Presidency, 2). optimism over a cease-fire with Hamas, 3). an incredible inflection in margins, profits, and EPS as a result of pricing actions round tripping stepped up CapEx/OpEx, and finally, 4). higher expectations for GDP growth in Israel in 2025.

On a valuation basis the shares traded as low as 12x trailing earnings in 2024, and reached a high of 25x trailing earnings just a few weeks ago. Since then they have also reported year end 2024 and Q4 earnings.

It’s hard to gauge expectations but results had a “mixed” reception, which has since turned into something of a rout. Post-earnings, shares now trade at something like ~18.5x trailing earnings which is about where they traded post-last quarter’s results.

Certainly from the macro-economic perspective there’s several reasons why many (foreigners especially) may have a dimmer view of Israel politically. The ceasefire with Hamas in Gaza was breached in short order, with both sides blaming the other. Subsequently, Israel has begun a full scale blockade of Gaza, and they have been carrying out limited air strike in Syria, which has come under revolutionary new leadership. There is of course uncertainty around mobilisations which impacted Israeli GDP in a significant manner since October 7th, 2023. Consequently, there have been myriad political issues related to Israel’s ongoing internal politics. Ronen Bar, the head of Shin Bet, was acrimoniously fired several weeks ago by Netanyahu in a move that was widely recognised as unprecedented.

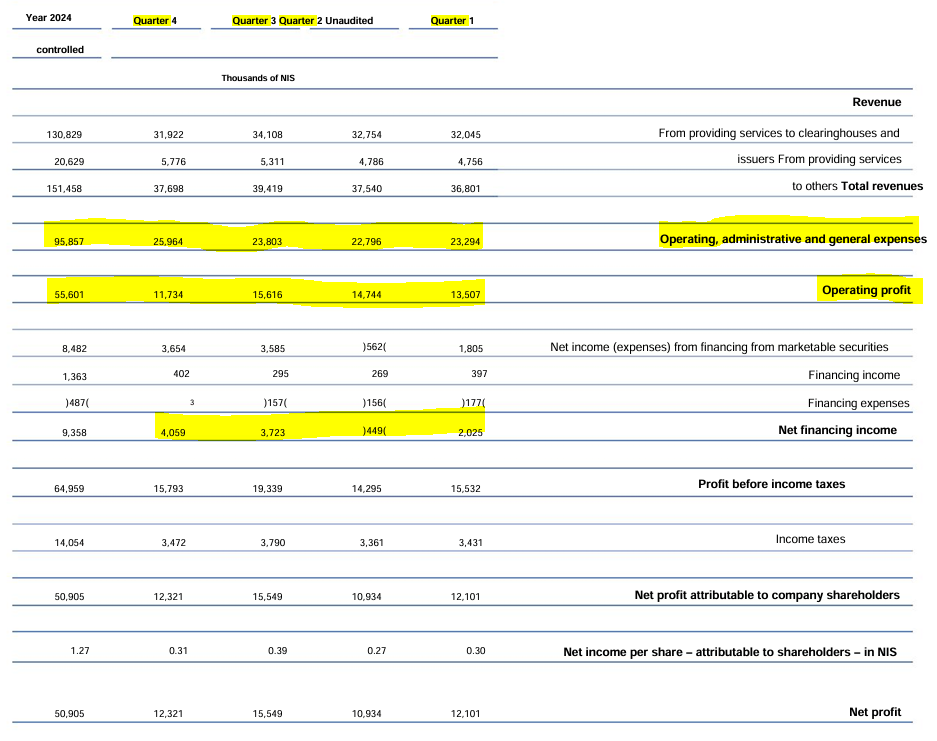

With respect to SHVA’s business, Q4 results seemed perfectly decent:

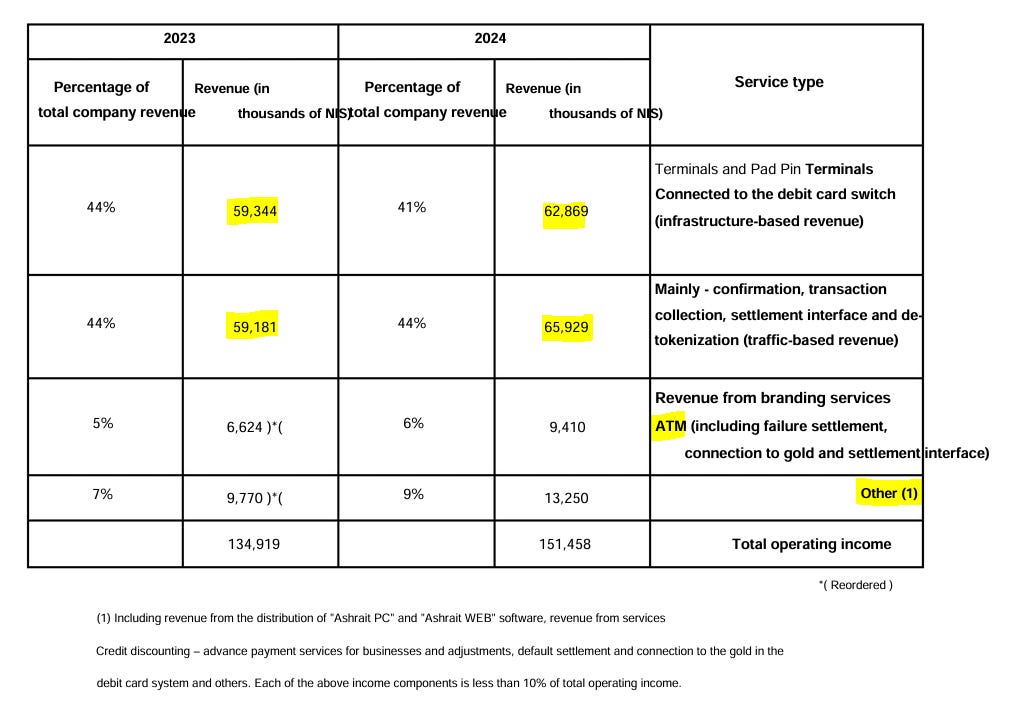

The company also broke out segmented results on an annual basis:

This is probably as close as we’re going to get to some kind of recognition of how the Value Added Services (VAS) are performing. This is, of course, important to know because they are undoubtedly the rationale for yet another step up in operating expenses (see above) - although these may be attributable to other things, such as switching failing for fours in mid-February.

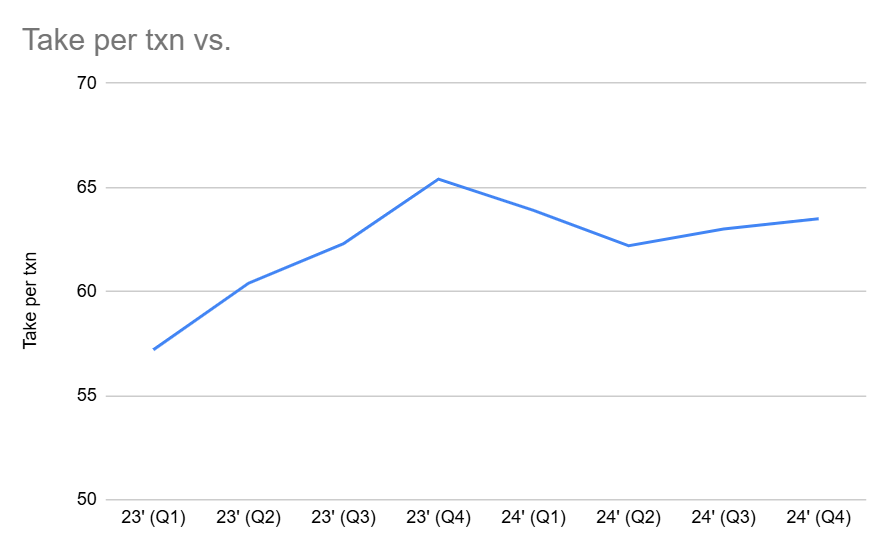

The dynamic that played out last quarter - that being a reduction in YoY operating expenses leading to very unusual incremental margins and EPS growth - did not repeat this quarter. To be sure incremental operating margins clocked in at 45% (down from over 100% last quarter), but QoQ revenues decelerated at a rate I was not entirely anticipating, and importantly, SHVA’s take per transaction declined for reasons which are largely unclear:

When SHVA revised their rate card in early 2023, they gave up take rate on intra-bank transactions (ON US - where the issuer and merchant acquirer are represented by the same bank) in return for additional take rate in the more complex transactions (inter-bank and tokenised). Generally, the trend has been positive since the rates were updated but it is appearing that the pricing changes were perhaps not enough to weather random or seasonal fluctuations in the transaction type. Certainly the company’s narrative around the growing importance of tokenised transactions (derived from digital wallets) is put into a little doubt with a year of subsequent transaction rate stagnation. We will see.

In any event management announced a 20% bump in the annual dividend, quarterly EPS growth of 30% (including financing income, which came in unusually hot), and highlighted the Bank of Israel’s projection of 7.5% growth in personal consumption in 2025. How much weight you put behind projections is up to you, but the resumption of regular GDP growth in Israel will be nothing but a boon for SHVA’s switching business. Keep in mind that transaction revenue grew at 10%+ in 2024 with flat a GDP reading, and comparative annual take rates were similar.

Significant developments in the various risk factors discussed elsewhere do not seem to have experience material developments. While maybe not as tantalising as it once was, shareholders are faced with the prospect of a business growing EPS and dividend at very strong rates, at likely a mid teens earnings multiple on a forward basis. We’re in small cap illiquid land - this is to be expected.

I have been adding to the position.

Grindr

Held.

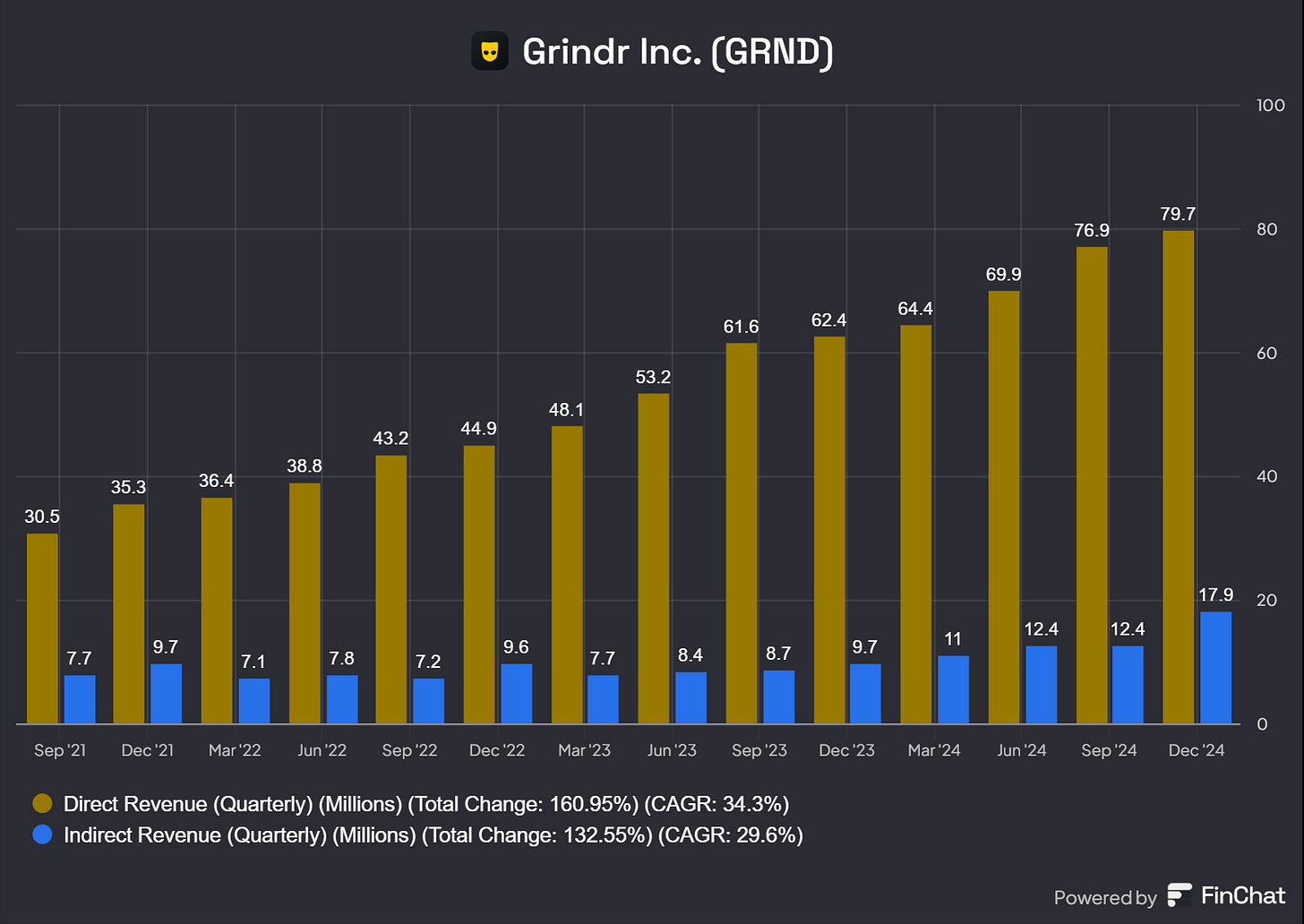

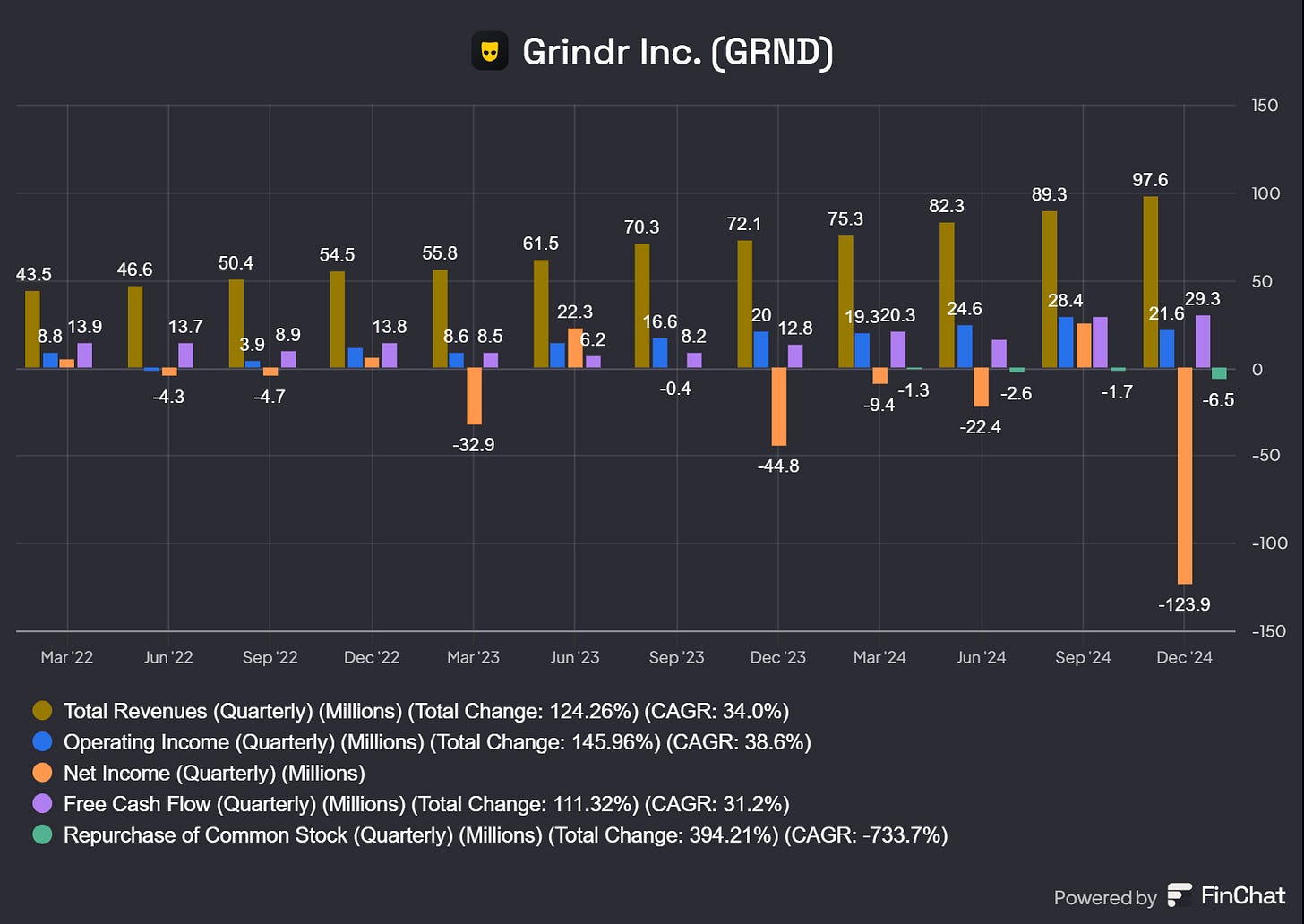

Unfortunately it is becoming quite fashionable to acknowledge how great of a money machine Grindr is. The extremely scalable nature of its offering, its predictable user growth, its low penetration (pun intended) of paying users, and relatively modest rate it charges for its paid product are all making their way to the fore. Additionally, the straightforward upgrades Grindr is doing to its AdTech are reaping enormous dividends for the company:

Importantly, Grindr authorised a $500M repurchase program and took steps to clean another part of its balance sheet. The outstanding warrants were redeemed by the company which catalysed at least one large shareholder to exercise.

Grindr had become something of a hedge fund hotel, and suffered a large sell-off post earnings (the so-called degrossing) as it miss analyst expectations for 2025 earnings and margins guidance. The sell off was a fairly auspicious opportunity for shareholders.

Calculating the fair value of the outstanding warrant liability has been a regular drag on reported net income over the last couple of years. Happily this is behind us and the company’s reported financials will be much cleaner going forward.

The rate of reinvestment going into the business will no doubt increase, which was well illustrated by the company’s large hiring spree and step up in operating expenses. My take is that the opportunities for reinvestment are good. How well management can handle their expense base going into the future is an open question. Importantly, no acquisitions were announced, nor was the general development pipeline altered in a way that would deviate too far away from the core homosexual use case.

Good news.

I have been adding shares.

Autocount

Not held.

Well, it’s not often that the premise for an investment is invalidated 5 days after making a significant purchase.

Without rehashing too much of what I wrote elsewhere, the Malaysian government announced the permanent suspension of the e-invoicing mandate for about 700,000 potential cloud customers for Autocount and other service providers. This materially altered the special situation aspect of Autocount, and made its near term earnings multiple much less attractive. I’m a big believer in business and thesis momentum. When it’s good I stick with it. When things begin to change dramatically, I’m looking to be a seller at the earliest opportunity. Sales crystallised a permanent loss of capital of between 15-20% in fairly short order on the position. Proceeds were recyled into the names above.

We pray for forgiveness and then we move on.

Larry.

FWIW, I like this format for coverage updates - thanks Larry