Held.

The previous TASE update can be found here.

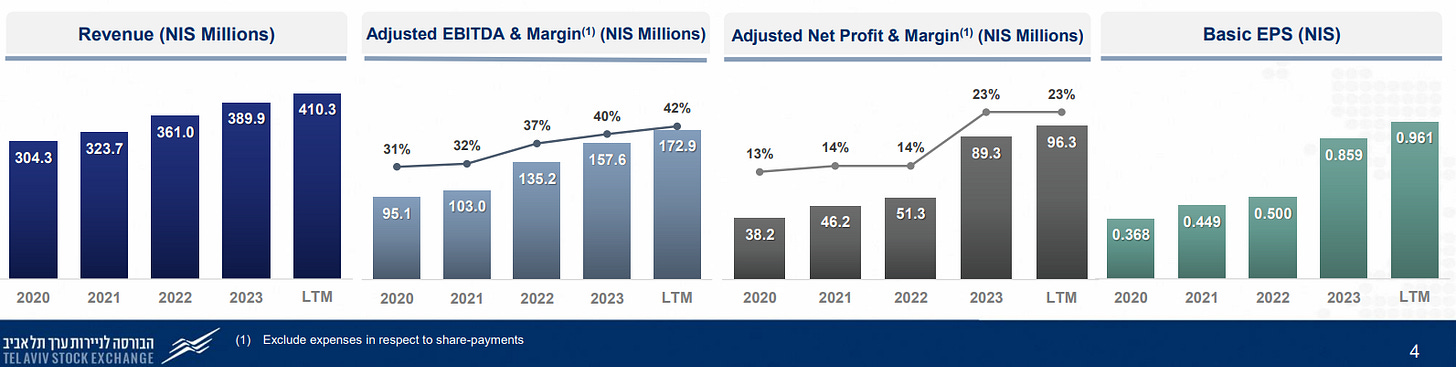

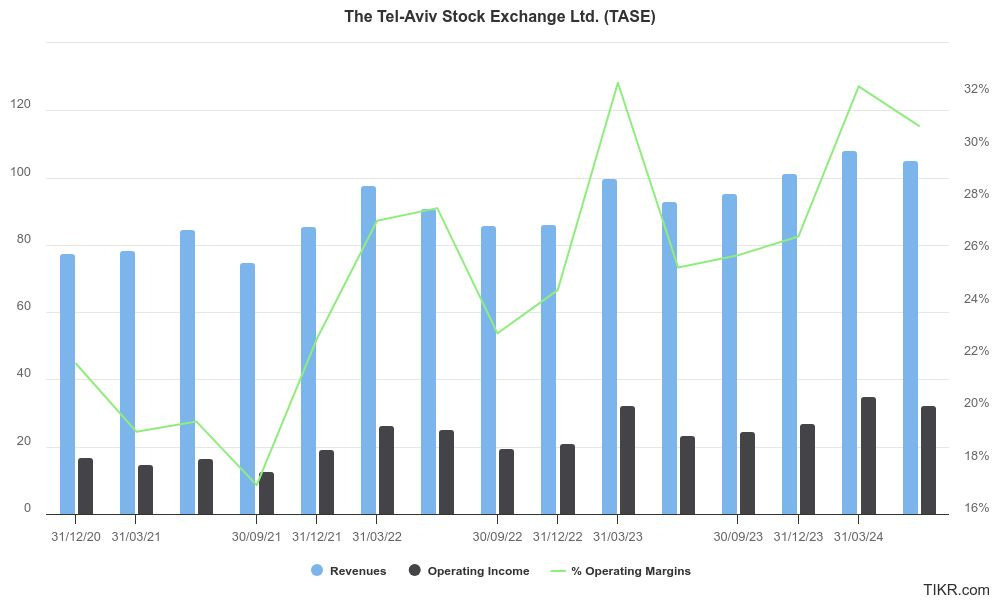

We conclude Q2 2024 with strong performance in all TASE core activities and further organic growth, with this all being against the backdrop of the October 7 war.

We have witnessed significant growth in our quarterly revenues, which are up 13% on the same quarter last year and a 29% increase in adjusted EBITDA. Our EBITDA margin rose to 44% and adjusted net profit also increased.

Ittai Ben-Zeev, TASE CEO, Q2 2024 earnings call

Tel Aviv Stock Exchange posted very strong Q2 operating results last Thursday, building on almost four years of sustained business improvements as a publicly traded company. While the geopolitical situation continues to be extremely fluid - as of this writing there is another flare-up in hostilities with Hezbollah and, potentially, the Iranians - TASE has proven to be extremely robust, perhaps even anti-fragile.

Highlights for the Quarter

(All numbers NIS Millions)

105.1 Revenue - 13% YoY Growth,

45.8 Adj. EBITDA - 29% YoY Growth,

25.7 Adj. net profit - 26% YoY Growth,

0.263 Basic EPS - 38% YoY Growth,

The theme of my last update is, not so strangely, the theme of this quarter too:

The realisation of future value will come from a fairly straightforward program of strong business execution, and the translation of th[at] business performance into shareholder returns.

On issuance volumes, TASE remains heavily weighted toward Treasury Bills and Bonds. This state affairs simply must continue while Israel is in a state of war with Hamas (and affiliated combatants), and would be exacerbated by an extension of hostilities into Southern Lebanon, and, possibly, Iran. The war effort requires massive resources, and TASE plays an essential part in the Israeli government raising debt finance. For example, the United States recently approved a $3.5B (USD) aid package for Israel.

Equity issuances remain relatively weak, however, it is a little encouraging to see the resumption of IPO’s in the quarter - an event that hasn’t occurred in almost two years:

TASE’s business in new issues is very advantaged, and robust. When equity markets are buoyant and optimistic, new equity issues come to the market. When markets are turbulent trading volumes pick up. When harder times demand more government spending, TASE plays a vital part in financing government deficits.

Keep reading with a 7-day free trial

Subscribe to Buyback Capital to keep reading this post and get 7 days of free access to the full post archives.