Held.

Find the previous update here. I have dropped FICO from my active coverage list, but, well, I just couldn’t keep away.

If you enjoy the work, and would like to support the writing long-term consider taking advantage of the newsletter’s annual Q1 Deal for 25% off annual subscriptions forever:

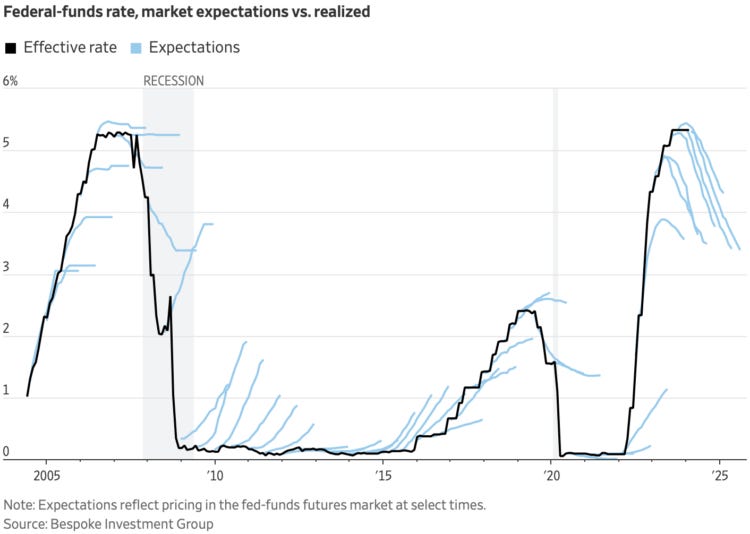

We’ve wrapped up the 2024 calendar year on significantly different footing than we began it with. Front of mind is the current state of rates:

If we can be sure of anything it’s that expectations are almost always wrong in the short term:

Trump’s schizophrenic policy announcements (including some indications that the DOGE apparatus has found fraud in Treasury) has also been affecting some of these Government sponsored end markets. We live in interesting times.

FICO

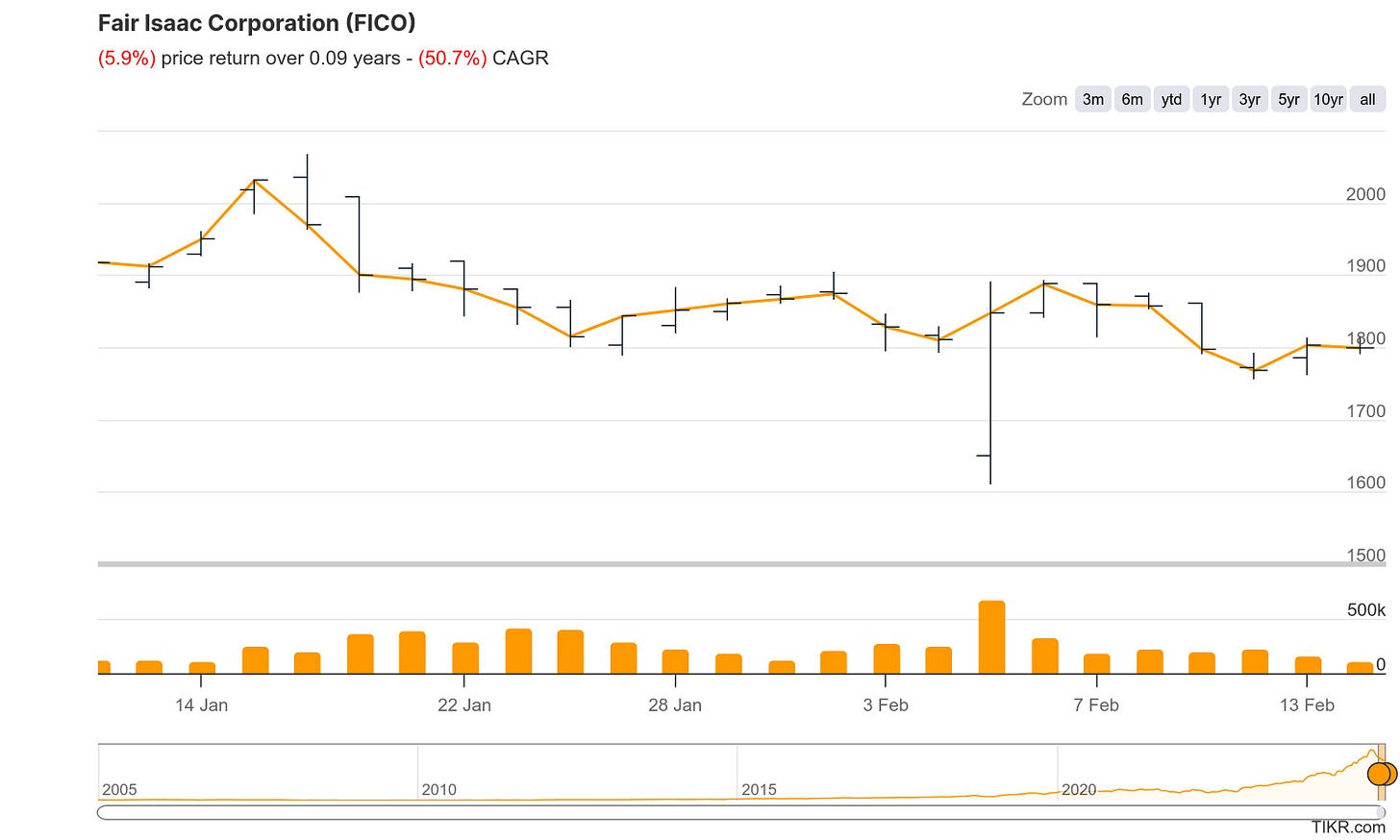

Well, the long awaited for drawdown (although that doesn’t sound exactly right) in the shares has finally arrived!

FICO reported earnings a week and half ago, with significant intraday trading volatility which hasn’t quite subsided yet:

As shown on Page 2 of the first quarter financial highlights, we reported quarter 1 revenues of $440 million, up 15% over last year. We reported $153 million in GAAP net income in the quarter, up 26% and GAAP earnings of $6.14 per share, up 28% from the prior year. We reported $144 million in non-GAAP net income in the quarter, up 19%; and non-GAAP earnings of $5.79 per share, up 20% from the prior year. As shown on Page 10, we delivered free cash flow of $187 million in our first quarter and $673 million over the last 4 quarters, an increase of 36% over the prior period.

Will Lansing, Q1 2025 Earnings Call

On the face of things this was a fairly predictable quarter (yet again). Certainly, what I highlighted in the last update - the noticeable pick up in revenue growth - has been what was interesting about this quarter. This requires a little context.

For most of the last two decades, FICO has been a very modest top line grower. This has been in part because the Scores business has closely mimicked growth in North American consumer credit (not exactly an enormous secular grower), but also because of the nuances in the Software business. Over the years, FICO has bought and sold various software businesses, but as of late the transactions have been all on the divestment side. Even with the price increases in Scores post-2018 top line revenue growth for the group has been modest.

The pricing actions that have taken place, and uh…. continue to take place, in mortgage are now contributing so much to group performance, that revenue growth is accelerating into the mid teens. I feel like a broken record, but it simply can’t be understated how impressive this is, as this kind of growth is largely incremental further down the income statement. To highlight how impressive the performance was this quarter:

This is with continued depressed volumes in underlying GSE mortgage issuance. I’m scratching my head even trying to think of a time when a business of equivalent quality grew so fast. In its entire run as a public company MCO’s Moody’s Investor Services has basically never grown over 20% per annum.1

Quarterly YoY growth trends at the group level were likewise excellent:

Basic EPS grew at over 28%!

I also noted in the last couple of updates how FICO has been accelerating their buyback program against an extraordinarily rich current valuation in their own shares:

As you can see above this has only accelerated - and I’m given to wonder: why?

Yes. Well, look, you know our view on this. We think FICO stock is a great value at $1,800 or $1,900 or $2,000, $2,100 as we did in the last quarter. And in the fullness of time, we're sure what we've indicated we try -- we're not really market timers. We try to be in the market kind of all the time with regular purchases to use up our cash flow and maintain our leverage at kind of a comfortable level.

That said, when the stock dips, we do sometimes size up our purchases, and we have a lot open on the authorization so that we have the ability to do that should we choose to ramp up. So kind of a long way of saying, we believe in the stock. We think it's a pretty good value where it is. And yes, we have appetite for more.

Will Lansing, Q1 2025 Earnings Call

I can only envisage a couple of scenarios which would make the current price attractive for continuing shareholders. Firstly, would be continued price taking in Scores at levels that would be equivalent with recent history. Ancillary to this would be some kind of complimentary pricing actions in other reporting lines (Automotive, for example). Secondly, we’re talking about some kind of normalisation in mortgage issuance and refinancing volumes. In the shortish term that would require prevailing interest rates to be quite a bit south of where they are now. Over the long term I’m fairly confident that volumes will normalise which, according to Equifax, would be somewhere between 2-3 times the volumes we are seeing today - but how long is the long term? The simple answer is that a 30-year fixed-rate pre-payable mortgage can be refinanced at anytime, and there are a lot of people who’ll sit on their 2.5-4.5% 30-year mortgages in lieu of prevailing interest rates that may be as much as 100% higher than that.

In any event, FICO’s management indicated that this may be more of a gradual process rather than a complete come-to-Jesus moment:

Yes, I mean, I think outside of pricing, there's a lot of -- I mean, even in terms of some of the volume assumptions we have, I mean, there are -- there were some really rough quarters last year in terms of volumes that should -- if not do much better. We think there'll probably be more of a return to normal. So there's a lot of areas we have without going into detail, where we're pretty confident that we were not going to have any trouble clearing our guidance for the rest of the year.

Steven Weber CFO, Q1 2025 Earnings Call

I included some sell sides projections on forward assumptions for vols and pricing in the last update - please go back and consult for your own assumptions here.

As the Trump Administration has been gearing up for a reorganisation of Fannie and Freddie, there have been a myriad of concerns raised about how FICO might be affected by these developments. Let’s start with the facts.

The GSE’s mandated use of the FICO Score some three decades ago in 1994. It had been in unofficial use before that time. Thereafter the Score was mandated by the freshly minted FHFA after the financial crisis, and that decision was reaffirmed by the same body in 2022. In conjunction, the FHFA also mandated the transition to a bi-merged credit report (please go back and read past updates to familiarise yourself). I have been arguing for a while now, that the timeline for implementing a bi-merged regime was as uncomfortable to the mortgage industry as it was inconvenient. Almost no one wins along the value chain (ironically, FICO would be the least affected) excepting Vantage Score. Vantage is of course owned by the three large Credit Bureaus, but they essentially gave up on 1/3rd of their credit report volumes in mortgage for its inclusion in the scoring process.

The new FHFA Director has put the transition timeline on hold indefinitely. Lansing made the following comment in his opening remarks during the earnings call:

FICO 10T for conforming mortgages sold to the GSEs will be rolled out based on the time line of the FHFA's implementation of enterprise credit score requirements. In January, the FHFA announced it no longer has a specific time line for the implementation.

You can imagine me doing a metaphorical victory lap (one of the few predictions in terms of speculative outcomes I’ve nailed). This is a definite win for almost everyone in this lending ecosystem, excepting the actual borrower unfortunately. This reflects reality - most mortgage originators are not ready for the transition - but also common-sense. In FICO’s particular case, it’s a very good thing.

I’ll digress. In or out of conservatorship Fannie and Freddie are regulated by the FHFA. Conservatorship gave Treasury and the FHFA almost unilateral powers to regulate their own relationship with both Fannie and Freddie. These powers, and certainly the authority to mandate certain credit scores, are not going into abeyance just because the GSEs are “privatised”. One way or another, Government sponsorship will endure, even if Conservatorship doesn’t.

Of course, what happens to the cost of insuring GSE mortgages once Fannie and Freddie become “private” again is a topic open to debate. If the Government acts rationally (a bit of an ask, I know) there’s no reason to think that g-fee rates will increase from where they currently are. If the Government makes some mistakes here, mortgage volumes could be affected by more expensive g-fee rates. Largely, this is something of a minor issue in the main given the FICO Score’s inherent pricing power.

I will once again state my indifference to the software business, but this was a relatively weak quarter in terms of platform performance, which is likely what evoked such a strong reaction in the stock:

The 20% growth YoY in the Platform ARR is significant lower than what management has guided analysts towards in the past - which has been something closer to ~30%. Apparently FX headwinds and lumpy deal flow affected numbers. As to whether or not that is true, I can’t really say. Nor do I care. Long live the FICO Score.

ACV booking were relatively weaker given recent performance.

I’ll suspend my usual reticent to comment on valuation. As of today, and by consensus estimates, FICO trades on a ~60ish multiple of forward earnings. This is of course still a very rich price for a company only growing their earnings power at 30% a year. The two questions that are pertinent to what the normalised earnings number is:

When and if do we return to a pre-Covid level of GSE mortgage volumes? and,

How far can pricing be taken in GSE mortgage Scores?

I’ll leave it to you to work out the destination analysis.

Larry.

Happy to be proven wrong.

Thank you for the update.

As you reference Equifax quantifies the (latent) upside optionality (reproduced below)

Have you thought through what the latent FICO Revenue; EBITDA; EPS optionality is?

---

The U.S. mortgage market assumed in our 2025 guidance is over 50% below its historic average hard credit inquiry levels. As the mortgage market recovers toward its historic norms at current mortgage pricing and mix and current TWN records, that represents on the order of $1.2 billion of annual revenue opportunity for Equifax. At current average mortgage growth margins, this would deliver adjusted EBITDA and adjusted EPS above the $700 million and $4 per share,