Held.

The previous Tel Aviv Stock Exchange update can be found here.

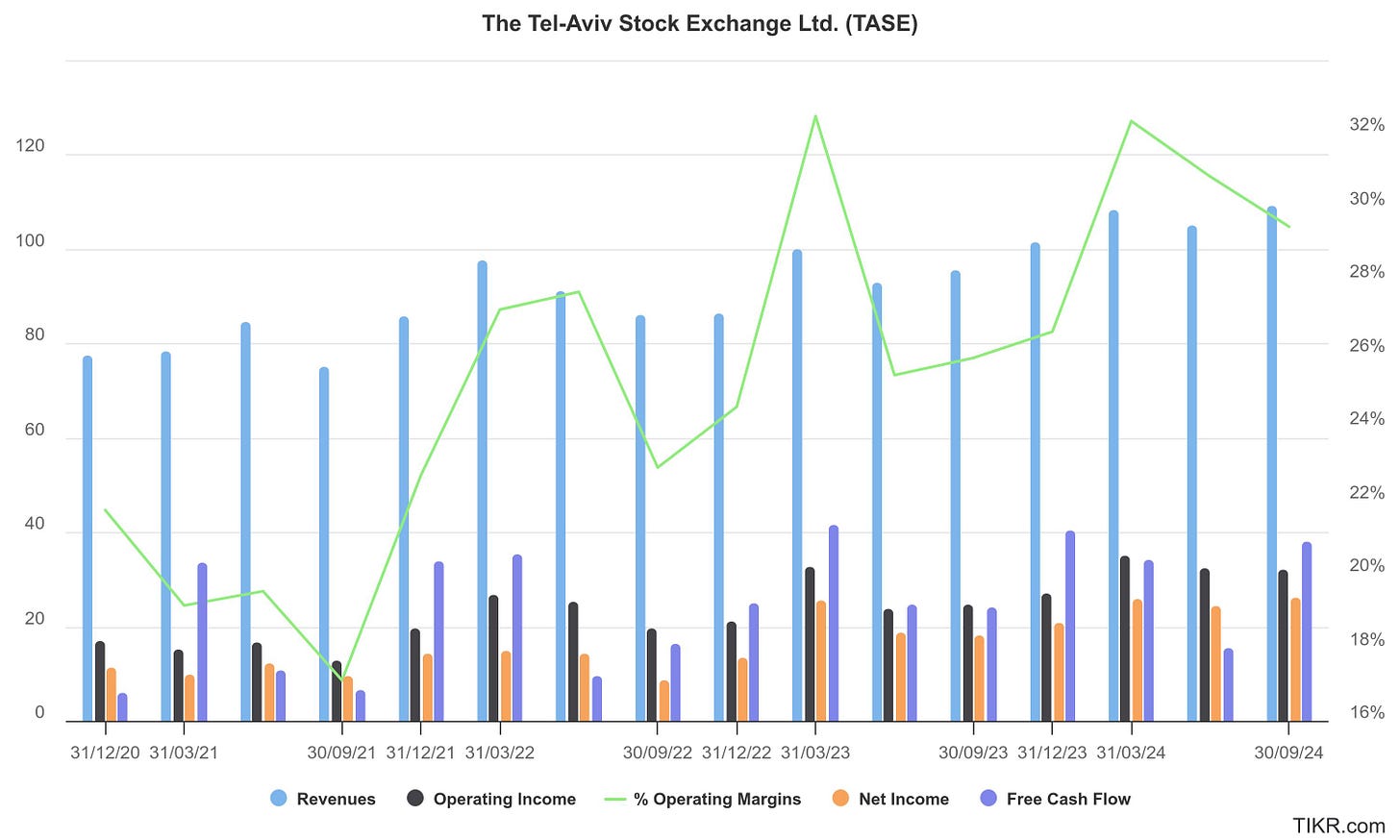

Tel Aviv Stock Exchange (TASE) remains one of the most interesting names I am actively covering. Usually when you’re right about a situation you learn nothing. However, sometimes your assumptions turn out to be so modest that, strictly speaking, you may as well have been wrong. It certainly helps that it hasn’t rerated to some astronomical multiple of earnings - 42x LTM earnings may as well be deep value around these parts.

They reported earnings in late November:

[W]e concluded Q3 2024 with strong performance and record results. This quarter's revenue grew significantly, up 14% on the same quarter last year, reaching a new high. Also, this quarter, we have seen a 17% increase in adjusted EBITDA as well as significant growth in the net profit, which was up 43% on the same quarter last year.

Ittai Ben-Zeev, TASE CEO

TASE’s story has been part special situation, part operational optimisation post mutual ownership (my initiation can be found here). While I was initially impressed by management’s ability to, frankly, get shit done, I dramatically underestimated the scale of opportunities available to drive additional business (and margins for that matter). As you can see blow, and indeed above, these efforts have been translating into pretty predictable financial performance:

The story that is left to play out - rather boringly - is simply the development of TASE’s assets to an equivalent level of what may be found elsewhere in equivalent developed Western exchanges. At the end of this path might be a takeout by one of the exchange conglomerates, but that is purely speculation in this analyst’s mind. In any event, they’re doing a pretty bang up job on the business development front but they’re also benefitting from current events.

To be fair it would also be disingenuous to simply describe TASE as purely an exchange business. In reality they are a collection of very unique assets which are at the very least exchange adjacent.

The Bond Business

One of the things that sets TASE apart from nearly any other exchange business in the world is its operation of the major forum for both the Government and Corporates to raise debt finance. As most will know, typically the main forum for raising debt finance, at both levels, has been through investment banks. Certainly, the trading of debt products has not lent themselves to the same kind of aggregation that equities have.

Keep reading with a 7-day free trial

Subscribe to Buyback Capital to keep reading this post and get 7 days of free access to the full post archives.